NY Chase Master/Visa Debit Merchant Dispute Resolution Process Form 2005-2026 free printable template

Show details

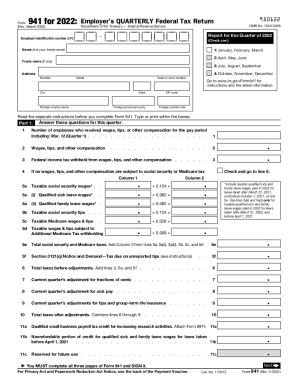

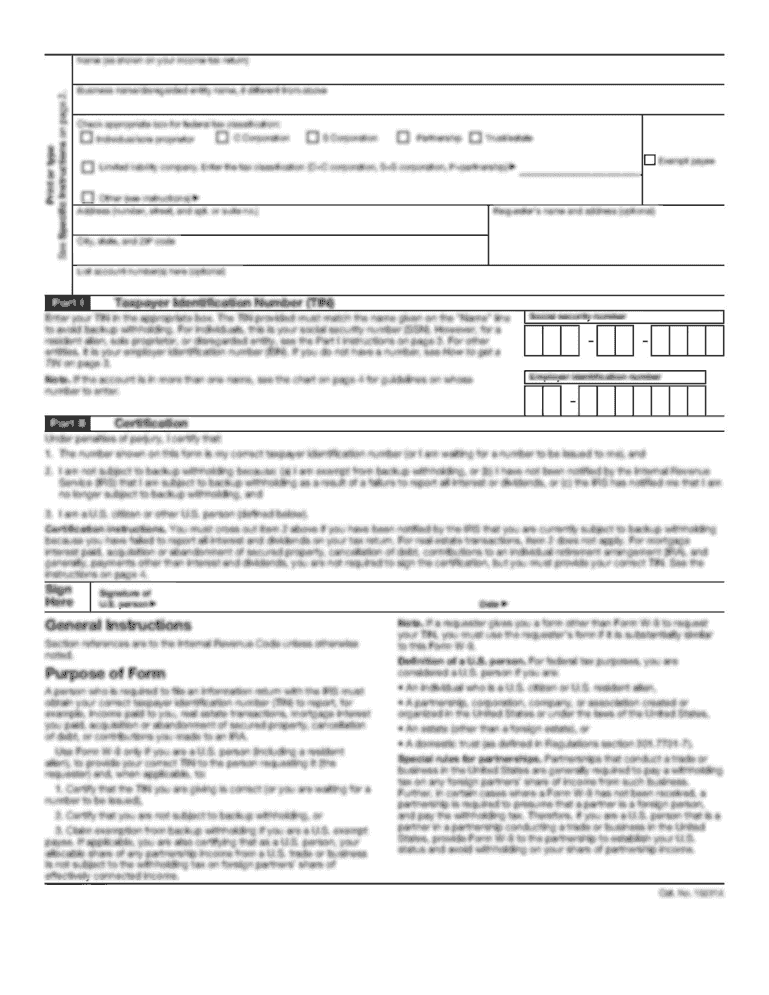

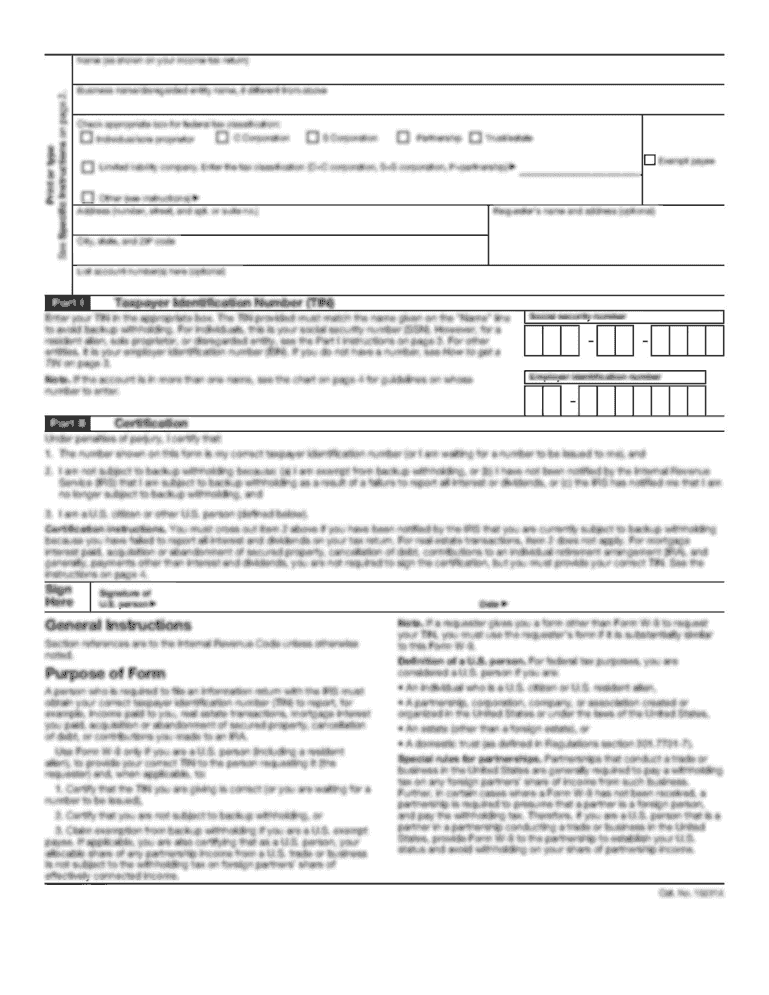

Master/Visa Debit Merchant Dispute Resolution Process Form Reason Code 37 Unauthorized Transaction Fax Form to Regulation E 516-574-7511 Description do not recognize the transaction card is in your possession there are under 3 transactions and/or the total amount does not exceed 800. Claim Procedure 1. Contact ServiceLine at 935-9935 and request assistance with reporting a Master/Visa Debit unauthorized transaction. Please obtain the claim SI c...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign chase statement of dispute form pdf download

Edit your statement of dispute chase form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your statement of dispute form chase form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chase statement of dispute online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit chase dispute form pdf. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out statement of dispute chase pdf form

How to fill out NY Chase Master/Visa Debit Merchant Dispute Resolution

01

Gather all relevant transaction details including date, amount, and merchant information.

02

Obtain the NY Chase Master/Visa Debit Merchant Dispute Resolution form from the Chase website or your account portal.

03

Fill in your personal information, including account number, name, and contact details.

04

Provide a detailed description of the dispute, including why you believe the charge is incorrect.

05

Attach any supporting documentation, such as receipts, emails, or other communication with the merchant.

06

Review the filled-out form for accuracy before submission.

07

Submit the completed form either online or by mailing it to the designated address provided by Chase.

Who needs NY Chase Master/Visa Debit Merchant Dispute Resolution?

01

Customers who have encountered unauthorized transactions on their NY Chase Master/Visa Debit card.

02

Individuals who believe they were charged incorrectly by a merchant.

03

Users who want to challenge a transaction due to unsatisfactory goods or services.

04

Anyone seeking to recover funds that they believe were charged in error.

Fill

chase dispute form

: Try Risk Free

People Also Ask about chase statement of dispute form download

How do I contact Chase to dispute a charge?

What do I do when I see an unauthorized charge? If your card is lost or stolen, or you think someone used your account without permission, tell us immediately by calling 1-866-564-2262 for debit card customers, 1-800-955-9060 for credit card customers, and 1–888–269–8690 for business credit card customers.

How do I email a dispute form?

I am writing to dispute a charge of [$] to my [credit or debit card] account on [date of the charge]. The charge is in error because [explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc.].

How long do you have to file a dispute with Chase?

You typically have 60 days from the statement date that reflects the unauthorized charge to dispute it. The time limit may also depend on your card issuer, so check your cardmember agreement to confirm how much time you have.

How do I file a dispute with Chase?

Here's how: After signing in, find and select the transaction you are concerned about. Review the transaction details and click Dispute Transaction to start the process. Answer a few questions, review your responses and click Submit dispute. Track your dispute in the Account Menu under Account Services.

Is Chase good with disputes?

Our team is available to help you challenge and win disputes. You'll be notified when a formal dispute claim has been made and we don't have the documentation needed to challenge. You have a limited time to submit proof that the charge was legitimate.

Is it easy to dispute a charge with Chase?

Here's how: After signing in, find and select the transaction you are concerned about. Review the transaction details and click Dispute Transaction to start the process. Answer a few questions, review your responses and click Submit dispute.

Does Chase have a dispute limit?

You typically have 60 days from the statement date that reflects the unauthorized charge to dispute it. The time limit may also depend on your card issuer, so check your cardmember agreement to confirm how much time you have.

How does Chase bank handle disputes?

Most of the time, a provisional credit will be applied to the account while we investigate the debit card dispute. This usually occurs within 48 hours but may take up to 10 business days.

What happens when you file a dispute with Chase?

The payment brand sends funds back to the card issuer to cover the dispute. Chase, in turn, debits the funds from your settlement account. Chase will send documentation about the disputed charge (which requires a timely response), or opens a case in the Online Dispute Management System, if your business subscribes.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit chase bank statement of dispute form from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including chase statement of dispute pdf. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I fill out chase bank statement of dispute form pdf download on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your statement of dispute chase template. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out statement of dispute chase download on an Android device?

Use the pdfFiller mobile app and complete your statement of dispute chase online and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is NY Chase Master/Visa Debit Merchant Dispute Resolution?

NY Chase Master/Visa Debit Merchant Dispute Resolution is a process designed to address and resolve disputes between customers and merchants regarding transactions made using Chase MasterCard or Visa debit cards. It provides a structured approach to filing and handling complaints.

Who is required to file NY Chase Master/Visa Debit Merchant Dispute Resolution?

Any customer who experiences an issue with a transaction made using a Chase MasterCard or Visa debit card, such as unauthorized charges or discrepancies, is required to file for NY Chase Master/Visa Debit Merchant Dispute Resolution.

How to fill out NY Chase Master/Visa Debit Merchant Dispute Resolution?

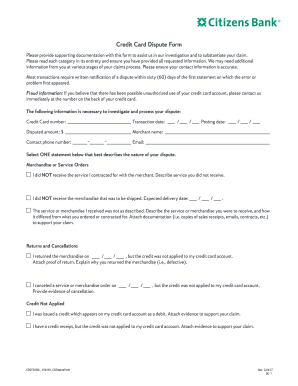

To fill out the NY Chase Master/Visa Debit Merchant Dispute Resolution form, one must provide personal information such as name, contact details, card information, transaction details, and a clear description of the dispute or issue encountered.

What is the purpose of NY Chase Master/Visa Debit Merchant Dispute Resolution?

The purpose of NY Chase Master/Visa Debit Merchant Dispute Resolution is to facilitate a fair and efficient process for resolving disputes related to debit card transactions, ensuring customer protection and merchant accountability.

What information must be reported on NY Chase Master/Visa Debit Merchant Dispute Resolution?

The information that must be reported on the NY Chase Master/Visa Debit Merchant Dispute Resolution includes the cardholder's name, contact information, transaction date, transaction amount, merchant name, and a detailed explanation of the dispute.

Fill out your NY Chase MasterVisa Debit Merchant Dispute online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement Of Dispute Form is not the form you're looking for?Search for another form here.

Keywords relevant to statement of dispute chase form pdf

Related to chase statement of dispute download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.